Experience that understands startup reality

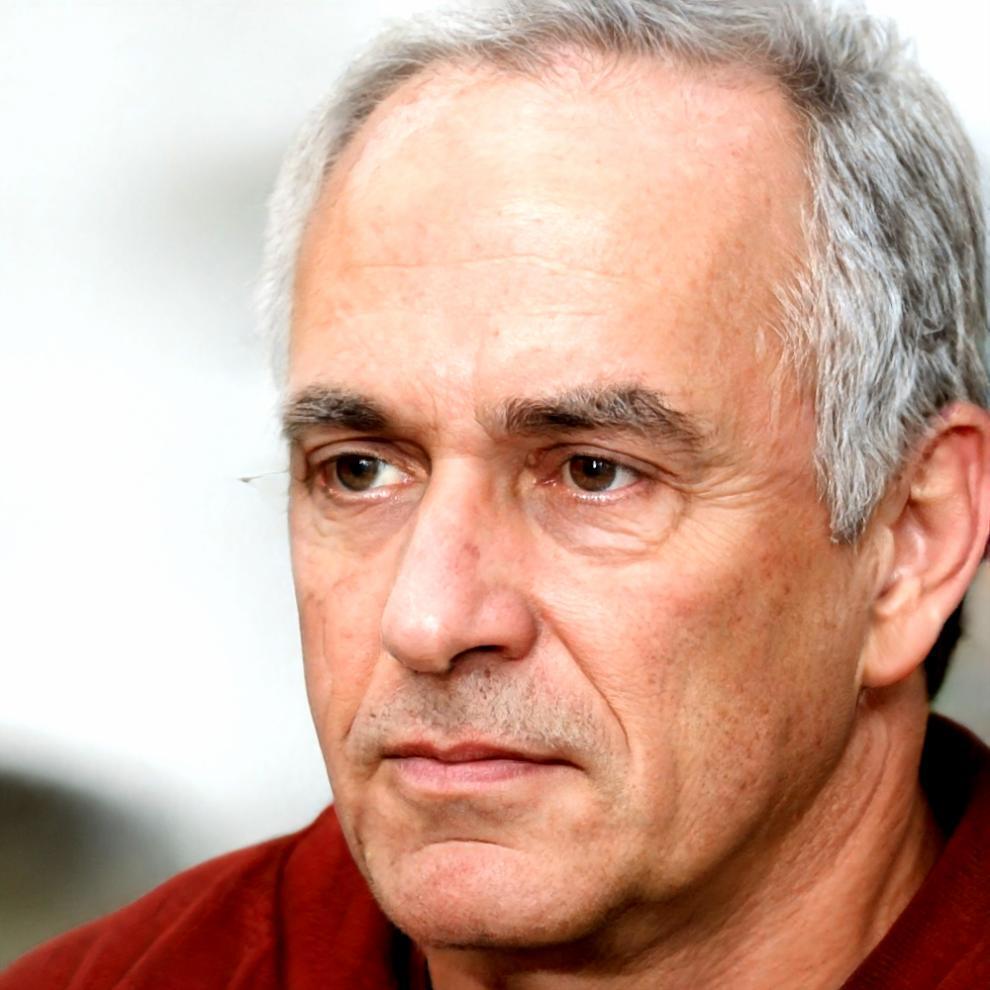

Marcus spent five years as CFO for three different startups before joining ralvexonir in 2022. He knows what it feels like when your burn rate suddenly spikes, when a major client payment gets delayed, or when you're preparing for investor due diligence on a tight deadline.

That experience shapes every conversation. Instead of theoretical advice, you get practical solutions from someone who's been in similar situations. Marcus specializes in cash flow management, fundraising preparation, and building financial systems that scale with rapid growth.